Are you thinking about making a move? If so, now may be the perfect time to start the process. That’s because experts say the best week to list your house is just around the corner.

A recent Realtor.com study looked at housing market trends over the past several years (with the exception of 2020, since it was an unusual year), and found the best week to put your house on the market this year is April 14th-20th:

“Every year, one week stands out from the rest as that perfect stretch of time when it’s great to be a home seller. This year, the week of April 14–20 is the best time to sell—that is, if sellers want to see lots of interest in their homes, sell quickly, and pocket some extra cash, according to Realtor.com® data.”

Here’s why this matters for you. While the spring market is a great time to sell no matter the week, this may be the peak sweet spot. And if you’ve been putting your plans on the back burner and waiting for the right time to act, this could be the nudge you need to make your move happen. As Hannah Jones, Senior Economic Research Analyst at Realtor.com explains:

“The third week of April brings the best combination of housing market factors for sellers. The best week offers higher buyer demand, lower competition [from other sellers], and fewer price reductions than the typical week of the year.”

But, if you want to get in on the action, you’ll need to move quickly and lean on the pros. Your local real estate agent is the perfect go-to when it comes to figuring out a plan to prep your house and get it on the market.

They’ll be able to offer advice to balance your target listing date with what you need to do from a repair and renovation standpoint. And they can walk you through exactly how to prioritize your list so you know what to tackle first.

For example, if your house is already in good shape, you’ll be able to really focus in on the smaller things that are easy to do and make a big impact. As an article from Investopedia says:

“You won’t have time for any major renovations, so focus on quick repairs to address things that could deter potential buyers.”

Just remember, even if you’re not ready to list within the next couple of weeks, that’s okay. The window of opportunity doesn’t close when this week ends. Spring is the peak homebuying season and it’s still a seller’s market, so you’ll be in the driver’s seat all season long.

Bottom Line: Ready to get the ball rolling? Let’s connect and schedule a time to go over your next steps. Sheila Davis, The Sheila Davis Group -The Norton Agency 770-235-6907. or use this contact me form

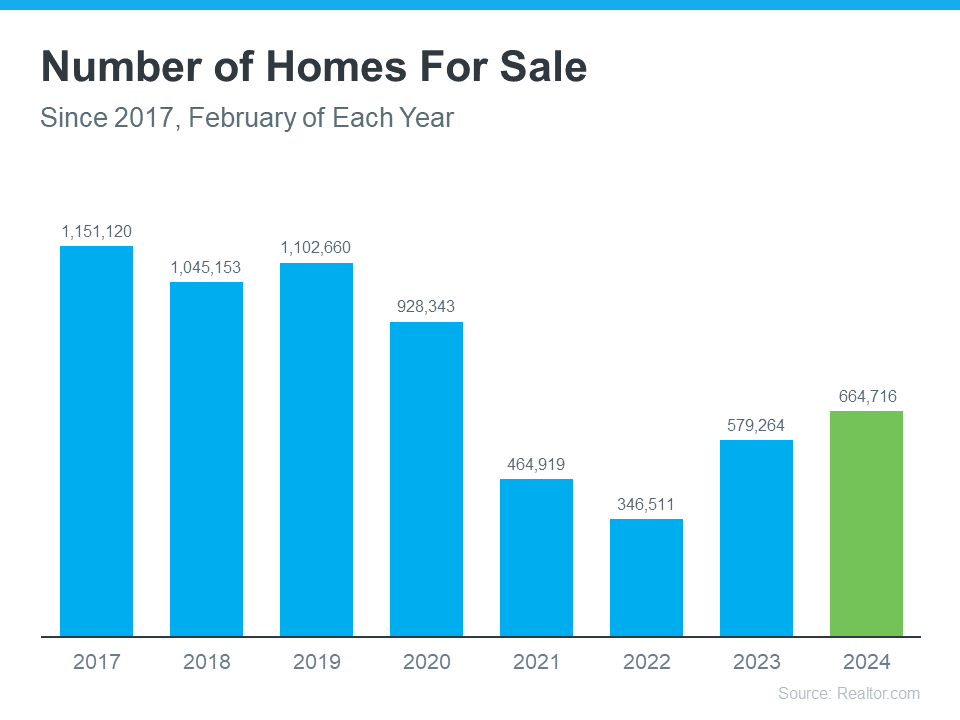

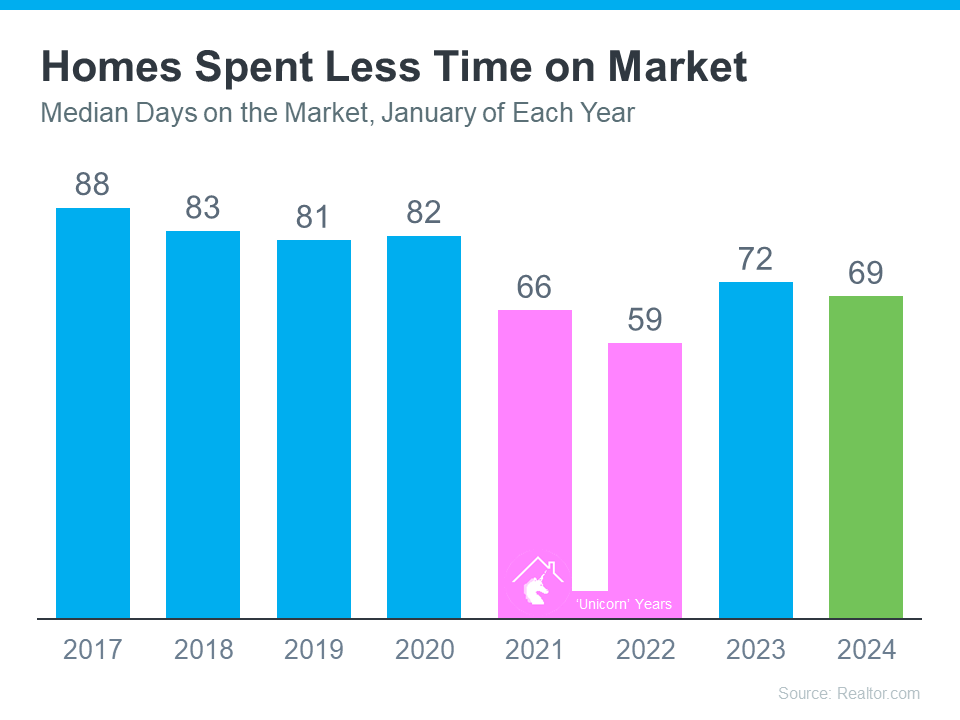

Have you been thinking about selling your house? If so, here’s some good news. While the housing market isn’t as frenzied as it was during the ‘unicorn’ years when houses were selling quicker than ever, they’re still selling faster than normal.

Have you been thinking about selling your house? If so, here’s some good news. While the housing market isn’t as frenzied as it was during the ‘unicorn’ years when houses were selling quicker than ever, they’re still selling faster than normal.

As the year winds down, you may have decided it’s time to make a move and put your house on the market. But should you sell now or wait until January? While it may be tempting to hold off until after the holidays, here are three reasons to make your move before the new year.

As the year winds down, you may have decided it’s time to make a move and put your house on the market. But should you sell now or wait until January? While it may be tempting to hold off until after the holidays, here are three reasons to make your move before the new year.

Are you thinking about selling your house as a For Sale by Owner (FSBO)? If so, know there’s a whole lot more time and expertise needed in that process than you might think. While the idea of doing it all by yourself might seem tempting, it’s important to recognize the challenges you may face if you take it on all by yourself. As a recent article from Bankrate explains:

Are you thinking about selling your house as a For Sale by Owner (FSBO)? If so, know there’s a whole lot more time and expertise needed in that process than you might think. While the idea of doing it all by yourself might seem tempting, it’s important to recognize the challenges you may face if you take it on all by yourself. As a recent article from Bankrate explains:

Selling your house is a big decision. And that can make it feel both exciting and a little bit nerve-wracking. But the key to a successful sale is finding the perfect listing agent to work with you throughout the process. A listing agent, also known as a seller’s agent, helps market and sell your house while advocating for you every step of the way.

Selling your house is a big decision. And that can make it feel both exciting and a little bit nerve-wracking. But the key to a successful sale is finding the perfect listing agent to work with you throughout the process. A listing agent, also known as a seller’s agent, helps market and sell your house while advocating for you every step of the way.